How fintech is enabling new ways of financing innovation sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

In this exploration, we will delve into the transformative impact of fintech on traditional financing models, the role of sustainable finance in driving innovation, and the evolving landscape of global investments in the realm of innovation.

Introduction to Fintech in Financing Innovation

Fintech, short for financial technology, refers to the use of technology to improve and automate financial services. In recent years, fintech has played a crucial role in revolutionizing the financial industry by providing innovative solutions to traditional banking and financial processes.

One area where fintech has made a significant impact is in the financing of innovation.

Changing the Way Innovation is Funded

Fintech has transformed the way innovation is funded by offering alternative financing options to entrepreneurs and startups. Traditional methods of funding innovation, such as bank loans and venture capital, are often difficult to access and come with strict requirements. Fintech platforms, on the other hand, provide more accessible and flexible financing solutions, such as peer-to-peer lending, crowdfunding, and online lending marketplaces.

These platforms allow innovators to raise capital quickly and efficiently, without the need for a traditional financial intermediary.

Impact on Traditional Financing Methods for Innovation

The rise of fintech has disrupted traditional financing methods for innovation by offering a faster, more streamlined, and cost-effective approach to raising capital. Fintech platforms leverage technology to assess creditworthiness, automate the lending process, and reduce the overall cost of borrowing.

This has democratized access to funding for innovators who may not have been able to secure financing through traditional channels. Additionally, fintech has enabled investors to diversify their portfolios and participate in funding innovation projects that align with their interests and values.

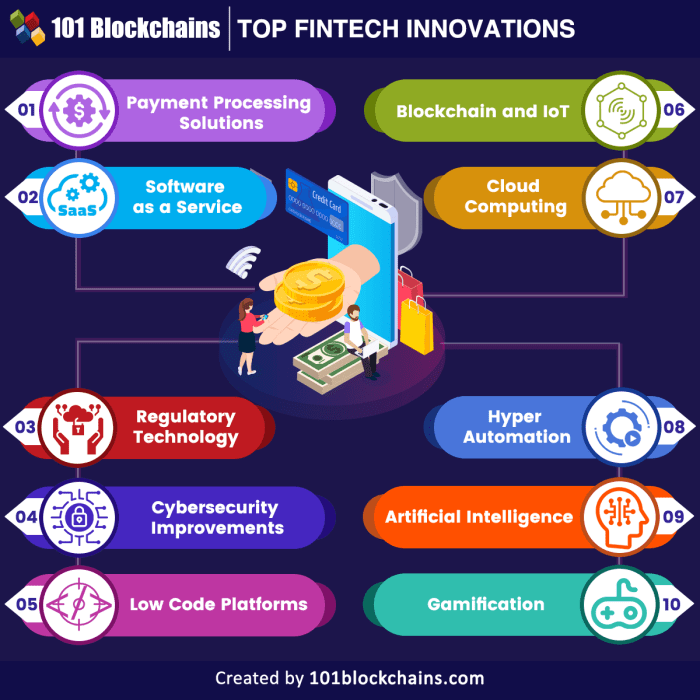

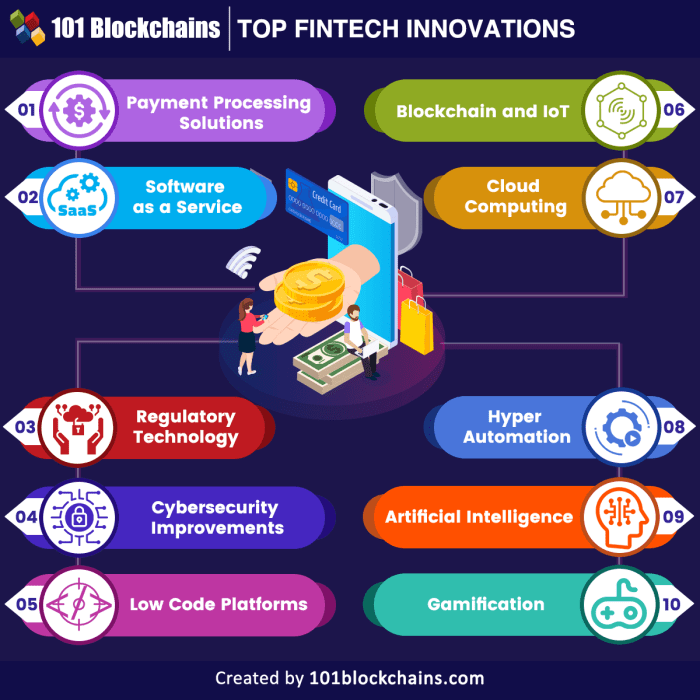

Tech-Driven Financing Solutions

Fintech companies are revolutionizing the way innovation is financed by leveraging various technological tools and platforms. These solutions offer a more efficient and streamlined approach compared to traditional methods, enabling faster access to funding for innovative projects.

Blockchain Technology

Blockchain technology is being utilized by fintech companies to create decentralized funding platforms. Through smart contracts and digital tokens, startups and entrepreneurs can access a global pool of investors without the need for intermediaries.

Artificial Intelligence

Artificial intelligence is used to analyze vast amounts of data to assess creditworthiness and risk profiles. This enables fintech companies to offer personalized financing solutions tailored to the needs of individual borrowers, increasing approval rates and reducing the time taken for funding.

Crowdfunding Platforms

Crowdfunding platforms provided by fintech companies allow individuals to invest in innovative projects and startups. By democratizing the investment process, these platforms enable access to capital for a wider range of projects that may not have been traditionally funded by banks or venture capitalists.

Sustainable Finance and Innovation

Sustainable finance plays a crucial role in funding innovation by providing long-term capital for projects that have a positive impact on society and the environment. It involves incorporating environmental, social, and governance (ESG) factors into investment decisions to ensure sustainable growth and development.

Fintech’s Role in Sustainable Financing

Financial technology (fintech) is revolutionizing the way sustainable financing is carried out for innovative projects. By leveraging advanced algorithms, big data analytics, and automation, fintech platforms are able to assess ESG risks and opportunities more effectively, providing investors with valuable insights into the sustainability performance of their investments.

- Through fintech, investors can access a wider range of sustainable investment opportunities, including green bonds, social impact bonds, and sustainable development projects.

- Platforms utilizing blockchain technology offer greater transparency and traceability in sustainable financing, ensuring that funds are allocated to projects with genuine sustainability credentials.

- Automated risk assessment tools help investors identify and mitigate ESG risks, leading to more informed investment decisions that support long-term sustainability goals.

Driving Long-Term Innovation and Growth

Sustainable finance plays a critical role in driving long-term innovation and growth by fostering a culture of responsible investment and supporting projects that address global challenges such as climate change, resource scarcity, and social inequality.

Sustainable finance not only provides financial support for innovative projects but also encourages companies to adopt sustainable business practices, leading to operational efficiencies, enhanced reputation, and long-term value creation.

- By incentivizing innovation in sustainable technologies and business models, sustainable finance accelerates the transition to a low-carbon economy and promotes the development of resilient and inclusive societies.

- Through collaboration with government agencies, non-profit organizations, and academia, sustainable finance drives cross-sector partnerships that enable the scaling of innovative solutions and the creation of sustainable value chains.

- Overall, sustainable finance serves as a catalyst for long-term innovation and growth by aligning financial interests with environmental and social objectives, ensuring a more sustainable future for generations to come.

Global Investing Insights in Fintech

Global fintech investments are experiencing significant growth, with a focus on financing innovation across borders. This trend is reshaping traditional investment models and fostering collaboration between investors and startups worldwide.

Impact of Cross-Border Investments

Cross-border investments in fintech are playing a crucial role in financing innovation by providing access to capital from different regions. This enables startups to scale their operations globally and tap into diverse markets, fueling innovation and driving economic growth. The seamless flow of capital across borders is breaking down barriers and fostering a more interconnected ecosystem for innovation.

Bridging the Gap Between Investors and Startups

Fintech platforms are revolutionizing the way investors connect with innovative startups, offering streamlined processes for funding and investment. By leveraging technology, these platforms provide efficient matchmaking between investors seeking opportunities and startups in need of funding. This direct access to capital is empowering startups to bring their innovative ideas to life and drive positive change in various industries.

Personal Finance Mastery and Innovation

In today’s digital age, fintech has revolutionized the way individuals manage their personal finances and invest in innovation. By leveraging fintech tools and platforms, individuals can take control of their financial health and actively participate in funding innovative projects. Let’s explore some key aspects of personal finance mastery and innovation.

Tips for Leveraging Fintech for Personal Finance Management and Investment

- Utilize budgeting apps to track expenses and set financial goals.

- Explore robo-advisors for automated investment strategies based on your risk tolerance and financial objectives.

- Consider peer-to-peer lending platforms for alternative investment opportunities with potentially higher returns.

- Use digital wallets and payment apps for seamless transactions and better money management.

The Importance of a Financial Mindset in Supporting Innovation

Having a financial mindset is crucial in supporting innovation through personal finance decisions. By understanding the impact of financial choices on long-term goals and investments, individuals can allocate resources effectively to nurture innovation.

Empowering Individuals to Fund Innovative Projects through Fintech

Fintech platforms enable individuals to participate in funding innovative projects that align with their interests and values. Through crowdfunding and investment apps, individuals can contribute directly to startups and innovative ventures, fostering a culture of entrepreneurship and creativity.

Future Finance Experts and Innovation

In the ever-evolving landscape of finance, the future demands a new breed of experts who are well-versed in innovative financing methods. These professionals need to possess a unique set of skills and knowledge to navigate the complexities of fintech-driven innovation in the financial sector.

Key Skills and Knowledge for Future Finance Experts

- Understanding of emerging technologies: Future finance experts must stay abreast of the latest technological advancements such as blockchain, artificial intelligence, and data analytics to leverage these tools in innovative financing solutions.

- Adaptability and agility: With rapid changes in the financial industry, professionals need to be adaptable and agile in embracing new trends and methodologies.

- Analytical and critical thinking: The ability to analyze data, identify trends, and think critically is crucial for making informed decisions in innovation financing.

- Risk management expertise: Future finance experts should have a deep understanding of risk management principles to mitigate potential financial risks associated with innovative financing ventures.

Role of Education and Training in Developing Future Finance Experts

Education and training play a vital role in preparing future finance experts for fintech-driven innovation. Institutions need to offer specialized courses and training programs focusing on emerging technologies, financial innovation, and risk management to equip professionals with the necessary skills.

Career Opportunities in Fintech for Innovation Financing

- Financial Analyst specializing in fintech innovation: Analyzing market trends, evaluating investment opportunities, and implementing innovative financing solutions.

- Fintech Product Manager: Developing and managing financial products that cater to the needs of innovative startups and businesses seeking financing.

- Risk Management Specialist in fintech: Assessing and mitigating financial risks associated with innovative financing models and technologies.

- Fintech Compliance Officer: Ensuring regulatory compliance and ethical practices in fintech-driven innovation financing.

Green Financing and Sustainable Innovation

Green financing plays a crucial role in supporting sustainable innovation projects by providing funding for initiatives that have a positive environmental impact. This type of financing focuses on projects that promote energy efficiency, renewable energy, waste management, and other environmentally friendly solutions.

Fintech Platforms Supporting Green Financing

Fintech platforms are leveraging technology to support green financing initiatives by offering innovative solutions for investors and companies looking to fund sustainable projects. These platforms provide a more efficient and transparent way to connect investors with green projects, making it easier for them to allocate funds towards environmentally conscious initiatives.

- Blockchain technology is being used to create transparent and secure transactions for green financing, ensuring that funds are allocated to the intended projects.

- Data analytics tools are helping fintech platforms assess the environmental impact of projects, enabling investors to make informed decisions about where to allocate their funds.

- Automated investment platforms are making it easier for individuals to participate in green financing, allowing them to support sustainable projects with as little as a few dollars.

Benefits of Integrating Green Financing

Integrating green financing into innovation funding strategies offers several benefits, including:

- Driving positive environmental impact by funding projects that promote sustainability and reduce carbon emissions.

- Attracting socially responsible investors who are looking to support initiatives that align with their values and beliefs.

- Creating new opportunities for innovation and growth in industries focused on sustainability, such as renewable energy and clean technology.

Final Review

As we conclude our journey into how fintech is revolutionizing innovation financing, it becomes evident that the future of finance will be intricately intertwined with technological advancements and sustainable practices. The possibilities for funding innovation are expanding, offering new opportunities for growth and development in the ever-evolving landscape of finance.

FAQ Explained

What are some key benefits of tech-driven financing solutions compared to traditional methods?

Tech-driven financing solutions offer greater efficiency, transparency, and accessibility, streamlining the funding process and opening up opportunities for a wider range of innovators to secure financial support.

How can individuals leverage fintech for personal finance management and investment in innovation?

Individuals can utilize fintech tools for budgeting, investing, and tracking expenses, allowing for better financial decision-making and the potential to support innovative projects through targeted investments.

What is the role of green financing in supporting sustainable innovation projects?

Green financing focuses on funding environmentally friendly initiatives, encouraging the development of sustainable solutions that benefit both society and the planet. Fintech platforms play a crucial role in supporting these efforts by providing accessible and efficient funding mechanisms.