How to prioritize expenses with daily finance tips sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Strategic Financial Planning, Efficient Money Moves, Global Investing Insight, Daily Finance Tips, Financial Planning for Future Finance Experts, Sustainable Finance Practices, Tech-Driven Finance Solutions, Financing Innovation in Personal Finance, Financial Tips for Personal Finance Mastery, Global Finance Trends and Insights, Green Financing Strategies – all these topics encompass the essence of prioritizing expenses with daily finance tips, guiding individuals towards financial stability and growth.

Strategic Financial Planning

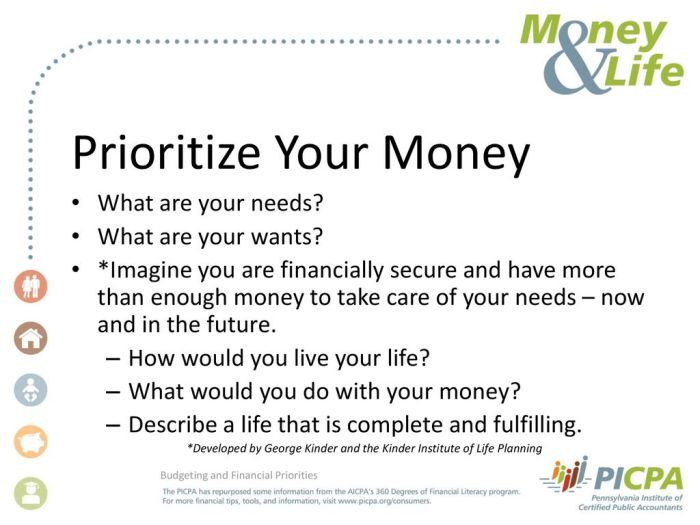

Creating a budget based on income and expenses is crucial for effective financial planning. By tracking your income sources and expenses, you can gain a clear understanding of your financial situation and make informed decisions.Setting financial goals and priorities helps you stay focused and motivated to achieve financial success.

Whether it’s saving for a major purchase, paying off debt, or building an emergency fund, having clear goals in place guides your financial decisions and actions.Tracking expenses is essential for identifying areas where you can optimize your spending. By categorizing your expenses and analyzing where your money is going, you can pinpoint areas where you can cut back or make adjustments to better align with your financial goals.

Importance of Budgeting

Creating a budget allows you to allocate your income towards different expenses and savings goals effectively. It helps you prioritize your spending and ensure you have enough money for essentials while saving for the future.

- Start by listing all your sources of income, including salary, side hustles, and any other earnings.

- Next, track all your expenses, categorizing them into fixed expenses (rent, utilities) and variable expenses (groceries, entertainment).

- Compare your income and expenses to identify any gaps or areas where you can cut back to balance your budget.

Remember, a budget is a flexible tool that should be adjusted regularly to reflect changes in your financial situation.

Setting Financial Goals

Establishing financial goals gives you a roadmap for your financial journey and helps you stay motivated to achieve them. Whether it’s saving for a vacation, buying a home, or retiring comfortably, setting clear goals guides your financial decisions.

- Define specific, measurable, achievable, relevant, and time-bound (SMART) financial goals to ensure they are realistic and attainable.

- Prioritize your goals based on their importance and urgency, focusing on one goal at a time to avoid feeling overwhelmed.

- Regularly review and adjust your goals as needed to stay on track and make progress towards financial success.

Tracking Expenses

Monitoring your expenses is essential for understanding where your money is going and finding opportunities to optimize your spending.

| Expense Category | Monthly Amount |

|---|---|

| Housing | $1,200 |

| Transportation | $300 |

| Groceries | $400 |

- Use budgeting apps or spreadsheets to track your expenses and categorize them for better analysis.

- Review your spending regularly to identify areas where you can cut back or make adjustments to align with your financial goals.

- Look for recurring expenses or subscriptions that you can cancel or renegotiate to reduce your monthly costs.

Efficient Money Moves

When it comes to managing your finances efficiently, there are several key strategies that can help you make the most of your money. By focusing on paying yourself first, reducing unnecessary expenses and debt, and finding ways to increase your income, you can set yourself up for financial success.

Paying Yourself First and Automating Savings

One important concept in efficient money management is to prioritize saving by paying yourself first. This means setting aside a portion of your income for savings before paying any bills or expenses. By automating your savings, you can ensure that this money is set aside consistently without having to think about it.

This can help you build up your savings over time and create a financial cushion for unexpected expenses or future goals.

Reducing Unnecessary Expenses and Debt

Another crucial aspect of efficient money management is to identify and cut down on unnecessary expenses. This can include things like eating out frequently, subscribing to services you don’t use, or making impulse purchases. By tracking your expenses and creating a budget, you can pinpoint areas where you can cut back and save more money.

Additionally, focusing on paying off high-interest debt can help you save money on interest payments and improve your overall financial health.

Increasing Income through Side Hustles or Investments

One way to boost your income and reach your financial goals faster is to explore opportunities for additional income. This could involve taking on a side hustle, freelancing, or starting a small business. Investing in assets like stocks, real estate, or other income-generating opportunities can also help you grow your wealth over time.

By diversifying your income sources, you can create a more stable financial foundation and increase your overall earning potential.

Global Investing Insight

Global investing offers a wide range of opportunities for diversification and potentially higher returns. It involves investing in assets outside your home country to spread risk and take advantage of growth in different markets. Here are some key insights to consider when venturing into global investing:

Benefits of Diversifying Investments

Diversifying investments across different asset classes, industries, and regions can help reduce risk and enhance overall portfolio performance. By spreading your investments globally, you can mitigate the impact of economic downturns in any single country or region. This strategy helps to balance the volatility of individual investments and create a more stable and resilient portfolio.

Tips for Researching Global Markets

- Conduct thorough research on the political and economic stability of the countries you are considering for investment.

- Stay informed about global trends, market developments, and geopolitical events that could impact your investments.

- Utilize online resources, financial news outlets, and research reports to gather information and insights on potential investment opportunities.

- Consider consulting with financial advisors or experts who specialize in global markets for valuable guidance and recommendations.

Insights on Risk Management and Long-Term Investment Strategies

- Implement risk management techniques such as setting stop-loss orders, diversifying across asset classes, and regularly reviewing your investment portfolio.

- Take a long-term perspective when investing globally, as short-term fluctuations are common in international markets. Focus on fundamental analysis and the growth potential of your investments over time.

- Stay disciplined and avoid making impulsive decisions based on market volatility. Stick to your investment plan and adjust it as needed based on changing market conditions.

Daily Finance Tips

When it comes to managing your finances on a daily basis, developing good habits is key. These daily finance tips can help you improve your financial literacy, maintain discipline, and stay on track with your budget.

Share daily habits for improving financial literacy and discipline

- Read financial news or articles daily to stay informed about the market trends and economic updates.

- Track your expenses regularly using budgeting apps or spreadsheets to understand where your money is going.

- Set specific financial goals for each day and work towards achieving them to stay motivated.

Provide tips for staying motivated to stick to a budget daily

- Reward yourself for sticking to your budget by treating yourself to something small when you reach a milestone.

- Visualize the long-term benefits of staying within your budget, such as saving for a big purchase or financial security in the future.

- Find an accountability partner who can support and encourage you to stay disciplined with your finances.

Discuss the importance of reviewing finances regularly for adjustments

Regularly reviewing your finances is crucial for making necessary adjustments to your budget and financial plan. It allows you to identify areas where you may be overspending, track your progress towards your goals, and make informed decisions about your money.

Financial Planning for Future Finance Experts

Financial planning is essential for individuals looking to secure their financial future. It involves setting specific goals, creating a roadmap to achieve them, and making informed decisions about managing your money. Whether it’s for short-term needs or long-term aspirations, having a financial plan in place can help you stay on track and make progress towards financial independence.

Setting Aside Emergency Funds

One crucial aspect of financial planning is setting aside emergency funds. These funds act as a safety net in case of unexpected expenses or income loss. Financial experts recommend having at least three to six months’ worth of living expenses saved in an easily accessible account for emergencies.

This can help you avoid going into debt or dipping into your long-term savings when unforeseen circumstances arise.

Planning for Retirement

Another vital component of financial planning is planning for retirement. It’s never too early to start saving for your retirement years, as the earlier you begin, the more time your investments have to grow. Consider contributing to retirement accounts such as 401(k)s, IRAs, or other pension plans to secure a comfortable retirement.

Determine how much you need to save based on your desired lifestyle in retirement and work towards that goal consistently.

Role of Investments in Achieving Financial Independence

Investments play a crucial role in achieving financial independence. By intelligently investing your money in assets that have the potential to grow over time, you can build wealth and secure your future. Diversifying your investment portfolio, staying informed about market trends, and seeking professional advice when needed can help you make sound investment decisions.

Whether it’s stocks, bonds, real estate, or other investment vehicles, strategic investing can help you reach your financial goals and attain financial independence.

Sustainable Finance Practices

In today’s world, incorporating sustainability into financial decisions is more important than ever. Sustainable finance practices not only benefit the environment but also contribute to social responsibility and long-term economic stability. By investing in companies that prioritize sustainability, individuals can make a positive impact on both the planet and society as a whole.

Investing in Sustainable Companies

- Research companies that have clear sustainability goals and initiatives in place.

- Look for companies that are transparent about their environmental impact and efforts to reduce it.

- Consider investing in green funds or ESG (Environmental, Social, and Governance) funds that specifically focus on sustainable investments.

- Monitor the performance of sustainable companies over time to ensure they continue to align with your values and sustainability goals.

Impact of Sustainable Finance

- Supporting sustainable companies can lead to innovations in clean energy, waste reduction, and conservation efforts.

- By investing in sustainable practices, individuals can help mitigate climate change and preserve natural resources for future generations.

- Sustainable finance can also promote social equity by supporting companies that prioritize fair labor practices and community engagement.

- Overall, incorporating sustainability into financial decisions can create a positive ripple effect that extends beyond individual portfolios to benefit the environment and society at large.

Tech-Driven Finance Solutions

Technology plays a crucial role in modern-day personal finance management, offering a variety of tools and platforms to assist individuals in budgeting, investing, and tracking expenses effectively.

Benefits of Budgeting Apps

- Access to real-time financial data and insights.

- Automated categorization of expenses for better organization.

- Customizable budgeting features to suit individual needs and goals.

- Reminder notifications for upcoming bills and financial goals.

Benefits of Investment Platforms

- Access to a wide range of investment options and opportunities.

- Portfolio tracking and performance analysis tools.

- Automated investment strategies based on risk tolerance and financial goals.

- Education resources and expert advice for informed investment decisions.

Leveraging Fintech Tools for Financial Planning

- Advanced algorithms for personalized financial recommendations.

- Integration with banking and financial accounts for holistic financial overview.

- Goal-setting and progress tracking features for better financial discipline.

- Security measures to protect sensitive financial information and transactions.

Financing Innovation in Personal Finance

In today’s fast-paced financial landscape, staying ahead of the curve with innovative financial products and services is crucial for effective budgeting and holistic financial management. Embracing financial innovation can lead to optimized financial decisions and improved financial well-being. Let’s explore some key aspects of financing innovation in personal finance.

Decentralized Finance (DeFi) and Digital Payments

- Decentralized Finance (DeFi) is a growing trend that leverages blockchain technology to provide financial services without traditional intermediaries. This can include lending, borrowing, and trading digital assets.

- Digital payments have revolutionized the way we transact, offering convenience and efficiency. From mobile wallets to contactless payments, embracing digital payment methods can streamline financial transactions and enhance financial management.

- With the rise of cryptocurrencies and stablecoins, individuals can explore alternative payment options and investment opportunities in the digital realm.

Embracing Financial Innovation with Caution

- While financial innovation can offer numerous benefits, it is essential to approach it with caution and manage associated risks effectively.

- Stay informed about the latest trends and developments in the financial technology space to make informed decisions about integrating innovative products or services into your financial strategy.

- Consider diversifying your financial portfolio to mitigate risks associated with emerging financial products or technologies.

- Seek advice from financial experts or consult relevant resources to understand the implications of embracing financial innovation on your personal finances.

Financial Tips for Personal Finance Mastery

Investing in your financial education is a crucial step towards achieving personal finance mastery. By mastering the basics of personal finance, improving financial decision-making skills, and adopting the right mindset and habits, you can take control of your financial future.

Develop a Budget and Stick to It

- Create a detailed budget outlining your income, expenses, and savings goals.

- Track your expenses regularly to ensure you stay within your budget.

- Make adjustments as needed to align your spending with your financial goals.

Build an Emergency Fund

- Set aside a portion of your income each month to build an emergency fund.

- Aim to save at least three to six months’ worth of living expenses in case of unexpected financial challenges.

- Keep your emergency fund in a separate account to prevent the temptation of dipping into it for non-emergencies.

Invest for the Future

- Start investing early to take advantage of compound interest and grow your wealth over time.

- Diversify your investment portfolio to minimize risk and maximize returns.

- Regularly review and adjust your investment strategy based on your financial goals and risk tolerance.

Global Finance Trends and Insights

Global finance trends play a crucial role in shaping the financial landscape worldwide. Understanding these trends and gaining insights into how they can impact personal finances is essential for effective money management.

Current Trends in Global Finance

- Increased digitalization of financial services leading to more accessible and convenient banking solutions.

- Rise of sustainable finance practices as environmental, social, and governance (ESG) criteria gain prominence in investment decisions.

- Growing importance of emerging markets in driving global economic growth and investment opportunities.

- Shift towards decentralized finance (DeFi) and blockchain technology revolutionizing traditional financial systems.

Geopolitical Events and Personal Finances

- Geopolitical events such as trade wars, political instability, and global conflicts can impact currency exchange rates, stock markets, and commodity prices.

- Uncertainty in the geopolitical landscape can lead to market volatility, affecting investment portfolios and retirement savings.

- Diversifying investments across different regions and asset classes can help mitigate risks associated with geopolitical events.

Adapting to Changing Global Financial Trends

- Stay informed about global economic indicators, central bank policies, and market trends to make informed financial decisions.

- Monitor currency fluctuations and interest rate changes to optimize savings and investment returns.

- Seek professional advice from financial advisors or experts to navigate complex global financial trends and maximize wealth growth.

Green Financing Strategies

Green financing is a concept that focuses on investing in environmentally friendly projects or companies that promote sustainability. It not only benefits the environment but also offers financial advantages to investors. Here, we will discuss the benefits of green financing, provide tips on investing in renewable energy or sustainable projects, and explain how it aligns with personal financial goals.

Benefits of Green Financing

- Reduction in carbon footprint and contribution to a cleaner environment.

- Potential for long-term financial gains as sustainable projects become more profitable.

- Alignment with global sustainability goals and regulations, reducing risks associated with non-compliance.

- Enhanced reputation and brand value for companies investing in green initiatives.

Tips for Investing in Renewable Energy or Sustainable Projects

- Research and identify reputable green energy companies or projects with a proven track record.

- Diversify your green investment portfolio to spread risks and maximize returns.

- Consider investing in green bonds or funds that specifically support sustainable initiatives.

- Stay updated on the latest trends and innovations in the green finance sector to make informed investment decisions.

Aligning Green Financing with Personal Financial Goals

- Set clear financial goals that include sustainability and environmental impact as part of your investment strategy.

- Evaluate the potential returns and risks of green investments to ensure they align with your overall financial plan.

- Seek professional advice from financial advisors with expertise in green financing to make sound investment choices.

- Monitor the performance of your green investments regularly and adjust your portfolio as needed to meet your financial goals.

Last Word

In conclusion, mastering the art of prioritizing expenses with daily finance tips is a journey worth embarking on. By implementing the insights shared in this narrative, individuals can take control of their financial well-being and pave the way for a secure future.

Questions Often Asked

How can I effectively track my expenses?

One way to track expenses effectively is by using budgeting apps or creating a detailed spreadsheet to monitor where your money is being spent.

What are some strategies for increasing income through side hustles?

Side hustles such as freelance work, selling products online, or offering services can be great ways to supplement your income and boost your financial resources.

How important is it to set financial goals and priorities?

Setting financial goals and priorities provides direction and motivation for your financial journey, helping you make informed decisions and stay focused on achieving your objectives.