Delving into The importance of global investing insights in global asset allocation, this introduction immerses readers in a unique and compelling narrative. By exploring the crucial role of global investing insights in diversifying investment portfolios and identifying opportunities in various markets, this guide aims to shed light on the significance of informed asset allocation strategies.

As we navigate through the complexities of global finance, understanding how global investing insights can impact financial decisions on a daily basis becomes increasingly vital. This overview sets the stage for a deep dive into the world of strategic financial efficient money moves, global investing insight for daily finance tips, and the intersection of financial planning with a strong personal finance mindset.

Importance of Global Investing Insights in Global Asset Allocation

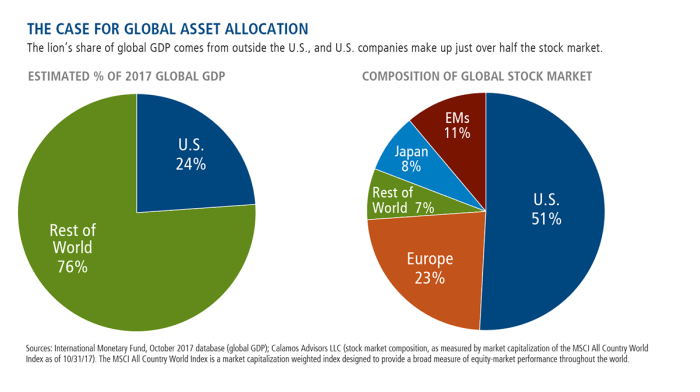

Global investing insights play a crucial role in diversifying investment portfolios, allowing investors to spread risk across different markets and asset classes. By gaining a deeper understanding of global trends, economic conditions, and market dynamics, investors can make more informed decisions when allocating their assets.

Identifying Opportunities in Different Markets

Global investing insights provide valuable information that can help investors identify opportunities in various markets around the world. For example, by analyzing geopolitical events, economic indicators, and industry trends, investors can pinpoint emerging markets with high growth potential or undervalued assets.

This allows them to capitalize on opportunities that may not be apparent through a purely domestic investment approach.

- By monitoring global economic data and market trends, investors can identify sectors or regions that are outperforming or underperforming relative to others.

- Global investing insights can also help investors uncover undervalued assets or companies in international markets, presenting opportunities for potential growth.

- For instance, during times of market volatility, global investing insights can help investors navigate uncertainty and capitalize on opportunities that may arise in different regions or asset classes.

Influencing Successful Asset Allocation Strategies

Global investing insights have a direct impact on shaping successful asset allocation strategies. By incorporating a global perspective into their investment approach, investors can achieve greater diversification, reduce risk, and potentially enhance returns over the long term.

“Global investing insights are essential for constructing a well-balanced portfolio that can withstand market fluctuations and capitalize on opportunities across different regions and sectors.”

- Successful asset allocation strategies often involve a mix of domestic and international investments to spread risk and capture growth opportunities worldwide.

- Global investing insights can help investors adjust their asset allocation based on changing market conditions, economic outlooks, and geopolitical events.

- By staying informed about global trends and developments, investors can make strategic decisions to rebalance their portfolios and optimize their risk-return profile.

Strategic Financial Efficient Money Moves

In the world of finance, making strategic decisions with your money is crucial to achieving financial success. Efficient money management plays a key role in helping individuals maximize returns and reach their financial goals. Let’s explore some tips and examples of strategic financial moves that can lead to success.

Portfolio Diversification

Diversifying your investment portfolio is a key strategy to minimize risk and maximize returns. By spreading your investments across different asset classes, industries, and regions, you can reduce the impact of volatility in any one area. This approach helps ensure that a downturn in one sector does not have a catastrophic effect on your overall portfolio.

Regularly Rebalancing Your Portfolio

Rebalancing your portfolio involves periodically reviewing and adjusting your investments to maintain your desired asset allocation. This practice ensures that your portfolio remains aligned with your risk tolerance and financial goals. By selling high-performing assets and buying underperforming ones, you can effectively buy low and sell high, optimizing your returns over time.

Building an Emergency Fund

Having an emergency fund is a critical component of sound financial planning. Setting aside a cash reserve that covers three to six months’ worth of living expenses can provide a financial safety net in case of unexpected events like job loss, medical emergencies, or major repairs.

By having this buffer, you can avoid dipping into your investments or going into debt during challenging times.

Automating Your Savings and Investments

Automating your savings and investments can help you stay disciplined and consistent with your financial goals. Setting up automatic transfers to your savings account or investment accounts ensures that you pay yourself first before spending the rest. This approach eliminates the temptation to spend money that should be saved or invested, helping you grow your wealth over time.

Seeking Professional Financial Advice

Consulting with a financial advisor or planner can provide valuable insights and guidance on making strategic financial decisions. An expert can help you develop a personalized financial plan, optimize your investment strategy, and navigate complex financial situations. By leveraging their expertise, you can make informed decisions that align with your long-term financial objectives.

Global Investing Insight for Daily Finance Tips

Global investing insights play a crucial role in providing daily finance tips to individuals looking to make informed financial decisions. By incorporating global trends into daily financial planning, individuals can gain a broader perspective on the market and potentially capitalize on opportunities that may not be apparent on a local level.

Impact of Incorporating Global Trends

- Global investing insights can help individuals stay ahead of market trends and make strategic investment decisions.

- By considering global factors, such as geopolitical events or economic indicators, individuals can better assess risk and potential returns.

- Understanding how global markets are interconnected can provide valuable insights into how local markets may be influenced.

Examples of Utilizing Global Investing Insights

For example, if a global investing insight indicates a potential slowdown in a specific industry due to international trade tensions, individuals can adjust their investment portfolio accordingly to mitigate risks.

- Monitoring global economic data, such as GDP growth rates or inflation rates, can help individuals make informed decisions on where to allocate their financial resources.

- Tracking global stock market performance can provide insights into emerging trends and sectors that may present attractive investment opportunities.

Financial Planning and Personal Finance Mindset

Having a strong personal finance mindset is crucial when it comes to financial planning. Your mindset shapes your attitudes, beliefs, and behaviors towards money, ultimately influencing the decisions you make regarding your finances.

Connection between Financial Planning and Personal Finance Mindset

- Financial planning involves setting goals, creating a budget, and making strategic decisions to achieve financial stability.

- A positive personal finance mindset is essential in approaching financial planning with discipline, motivation, and a long-term perspective.

- By aligning your mindset with your financial goals, you can stay focused, resilient, and proactive in managing your finances effectively.

Benefits of a Positive Personal Finance Mindset

- Improved decision-making: A positive mindset allows you to make rational financial decisions based on your goals and values rather than emotions or impulses.

- Increased financial confidence: Believing in your ability to achieve financial success can boost your confidence and empower you to take control of your finances.

- Resilience in facing challenges: With a positive mindset, you can navigate financial setbacks or unexpected expenses with a proactive and solution-oriented approach.

Tips to Cultivate a Mindset for Effective Financial Planning

- Set clear financial goals: Define your short-term and long-term financial objectives to guide your planning and decision-making.

- Practice financial discipline: Develop habits such as budgeting, saving, and avoiding unnecessary expenses to strengthen your financial discipline.

- Stay informed and educated: Continuously seek knowledge about personal finance, investment strategies, and economic trends to make informed decisions.

- Stay positive and resilient: Maintain a positive attitude towards financial challenges, setbacks, and uncertainties, focusing on solutions and learning opportunities.

Future Finance Experts and Sustainable Finance

In the ever-evolving landscape of finance, the role of future finance experts in promoting sustainable finance practices is becoming increasingly crucial. These experts play a vital role in shaping the future of finance by emphasizing the importance of sustainability in all financial decisions and strategies.

By integrating environmental, social, and governance (ESG) factors into investment decisions, these experts are driving a shift towards a more sustainable financial ecosystem.

Innovative Sustainable Finance Solutions

- Future finance experts are pioneering the development of innovative sustainable finance solutions, such as green bonds and impact investing. Green bonds are fixed-income securities that raise capital for projects with positive environmental impacts, while impact investing focuses on generating positive social and environmental outcomes alongside financial returns.

- These experts are also advocating for the integration of ESG criteria into investment analysis, ensuring that companies are evaluated not only based on financial performance but also on their environmental and social practices. This holistic approach to investing promotes long-term sustainability and resilience in financial markets.

- Furthermore, future finance experts are collaborating with policymakers, businesses, and investors to drive sustainable finance initiatives at a global level. By working together, they are able to create a more sustainable and responsible financial system that benefits both society and the environment.

Tech-Driven Finance and Financing Innovation

Technology has become a driving force in transforming the financial industry and fueling innovation. The integration of advanced technologies such as artificial intelligence, blockchain, big data analytics, and machine learning has revolutionized the way financial services are delivered and managed.

This digital transformation has not only enhanced operational efficiency but also opened up new possibilities for financial institutions to create innovative products and services.

Impact of Tech-Driven Finance on Global Financial Markets

- Increased Efficiency: Technology has streamlined processes, reducing manual errors and operational costs in financial transactions, leading to increased efficiency in global financial markets.

- Enhanced Accessibility: Digital platforms and mobile apps have made financial services more accessible to a broader range of consumers worldwide, democratizing access to investment opportunities.

- Risk Management: Advanced algorithms and predictive analytics have improved risk management practices, allowing financial institutions to make data-driven decisions and mitigate potential risks effectively.

Examples of Financing Innovation Reshaping the Financial Landscape

Blockchain technology has revolutionized the way transactions are conducted, offering greater transparency and security in peer-to-peer transactions.

- Fintech Startups: The rise of fintech startups leveraging technology to offer innovative financial solutions has disrupted traditional banking models and improved customer experience.

- Robo-Advisors: Automated investment platforms powered by algorithms and machine learning algorithms have made investing more accessible and affordable for individual investors.

- Smart Contracts: Smart contracts based on blockchain technology have automated contract execution, reducing the need for intermediaries and streamlining processes in various financial transactions.

Financial Tips for Personal Finance Mastery

Mastering personal finance is essential for achieving financial stability and success. By implementing actionable financial tips and continuously improving your money management skills, you can take control of your financial future and build wealth over time.

Create a Budget and Stick to It

One of the key strategies for mastering personal finance is creating a detailed budget that Artikels your income and expenses. Track your spending habits and identify areas where you can cut back to save more money. By sticking to your budget consistently, you can avoid overspending and ensure that your finances are in order.

Build an Emergency Fund

Another important financial tip is to build an emergency fund to cover unexpected expenses such as medical bills or car repairs. Aim to save at least three to six months’ worth of living expenses in a separate savings account. This fund will provide a financial safety net and give you peace of mind knowing that you are prepared for any unforeseen circumstances.

Invest Wisely for the Future

Investing is a crucial part of personal finance mastery, as it allows your money to grow over time. Research different investment options such as stocks, bonds, and real estate, and choose investments that align with your financial goals and risk tolerance.

Diversify your portfolio to reduce risk and maximize returns in the long run.

Educate Yourself Continuously

Continuous learning is key to mastering personal finance. Stay informed about financial trends, strategies, and best practices by reading books, attending workshops, and following reputable financial experts. Take advantage of online resources and tools to expand your knowledge and make informed decisions about your money.

Global Finance Trends and Green Financing

Global finance trends play a crucial role in shaping the financial industry, impacting markets worldwide. One significant trend that has gained traction in recent years is the rise of green financing. This form of financing focuses on investing in environmentally sustainable projects, with the aim of promoting a more eco-friendly and socially responsible approach to financial activities.

Impact of Green Financing on Global Financial Markets

Green financing has had a profound impact on global financial markets by encouraging the allocation of capital towards environmentally friendly initiatives. This trend has led to the development of new financial products and services tailored to support sustainable projects, thereby reshaping the investment landscape.

As investors increasingly prioritize sustainability in their investment decisions, green financing has become a driving force in shaping the future of finance.

Influence of Global Finance Trends on Sustainable Finance Practices

Global finance trends are instrumental in influencing the adoption of sustainable finance practices. As awareness of environmental and social issues grows, financial institutions and investors are integrating sustainability considerations into their decision-making processes. This shift towards sustainable finance practices not only aligns with ethical values but also presents opportunities for long-term financial growth and resilience in a rapidly changing world.

Final Wrap-Up

In conclusion, the exploration of The importance of global investing insights in global asset allocation highlights the transformative power of informed decision-making in financial matters. By embracing global trends, fostering a positive personal finance mindset, and staying abreast of innovative financing solutions, individuals can navigate the ever-evolving landscape of finance with confidence and proficiency.

FAQ Summary

How can global investing insights benefit my investment portfolio?

Global investing insights play a crucial role in diversifying your investment portfolio by helping you identify opportunities in different markets, thus reducing risk and potentially increasing returns.

Why is strategic financial decision-making important for maximizing returns?

Making strategic financial decisions is essential for maximizing returns as it ensures that your financial resources are allocated efficiently and effectively towards achieving your financial goals.

How can I incorporate global investing insights into my daily financial planning?

You can integrate global investing insights into your daily financial planning by staying informed about global trends, understanding how they impact financial markets, and using this knowledge to make informed decisions.